Making an Impact Across the Globe

Novim works on complex, contentious problems, focusing on issues that touch every citizen in every country.

- Pandemics (Covid-19)

- Climate Change

- Artificial Intelligence

- Energy

- Education

- Online Voting

Latest Novim News

Novim featured in May 2021 edition of STEM Magazine!!

Featured Projects

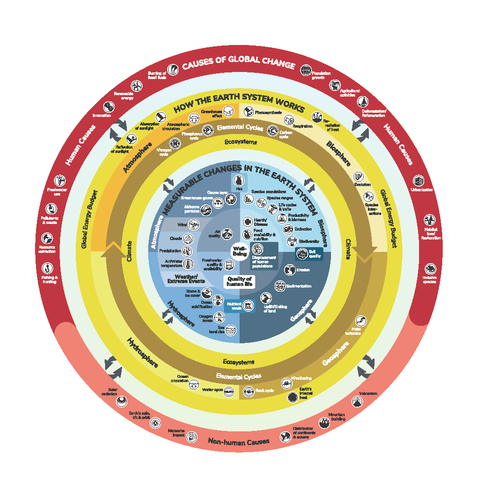

Understanding Global Change

Working with the University of California Museum of Paleontology at UC Berkeley, we have created a series of professional teacher development resources to support the instruction of climate change. This curriculum is being used by hundreds of teachers impacting thousands of students across the US. The project has been awarded grants by NOAA and the California Science Project.

Climate + Clean Energy

Novim is reconvening its original nuclear energy team to explore a combined study of climate + clean energy and the interaction of these two important challenges.

In preparation, Novim is testing an online teaching model allowing the user to alter the mix of how electric power in the U.S. is generated, the resulting cost of that electricity, greenhouse gas emissions, and the effect on global temperature.

A key proposition of the new study and model will be the elimination of coal-fired electrical generation in the U.S. by 2050.

Artificial Intelligence + Health Care

Novim is working with the University of California Santa Barbara and other partners, in a study of those areas where Novim could best make a contribution to this fast evolving and highly critical field.

COVID-19 and its effects on higher education and local economies is one area of focus.

Alliance to Beat Covid Partner

Novim is partering with the Global Coalition on Aging, Brandstream and others in the Alliance to Beat Covid. The Alliance was formed to promote community acceptance of the Covid vaccines now available. What is critical to beating this virus is the vaccination, not the vaccine. Vaccines are only effective for global health if widely adopted.

%

Percentage of Americans who would get vaccinated for COVID-19*

* Gallup, Nov 17 2020

%

Percentage of population required to be vaccinated for herd immunity**

** European Centre for Disease Prevention and Control

Proven Scientific Process

Most Novim projects utilize a research protocol developed by JASON, a select group of scientists that meet regularly to advise the US government on science and technology. Much of their recent work has focused on energy and climate change.

Read the Wall Street Journal interview with former JASON chairman and Novim Science Advisory Board member Steve Koonin.

Up To Date

Our Novim Newsletter keeps our friends and partners up to date on our latest projects and information. Sign up to join us.

Reach Us

Kohn Hall, University of California Santa Barbara

Santa Barbara, CA 93106

+1 (805) 284-0060

info@novim.org